What does asset liability management mean?

ALM analyses how investments fit into the structure of the foundation. Key factors include the age of the members, the number of pensions currently being paid out and the level of risk the foundation can absorb.

A foundation with large numbers of older members who require regular pension payouts will need secure and predictable investments, such as fixed-income securities or liquid assets that can be sold at any time. However, if the employee benefits unit is predominantly made up of younger employees and the company’s workforce remains stable, investing in assets with greater price volatility may also be a sensible option. This is because a long-term investment horizon leaves more time to compensate for potential downturns in the market.

Different foundations have different requirements

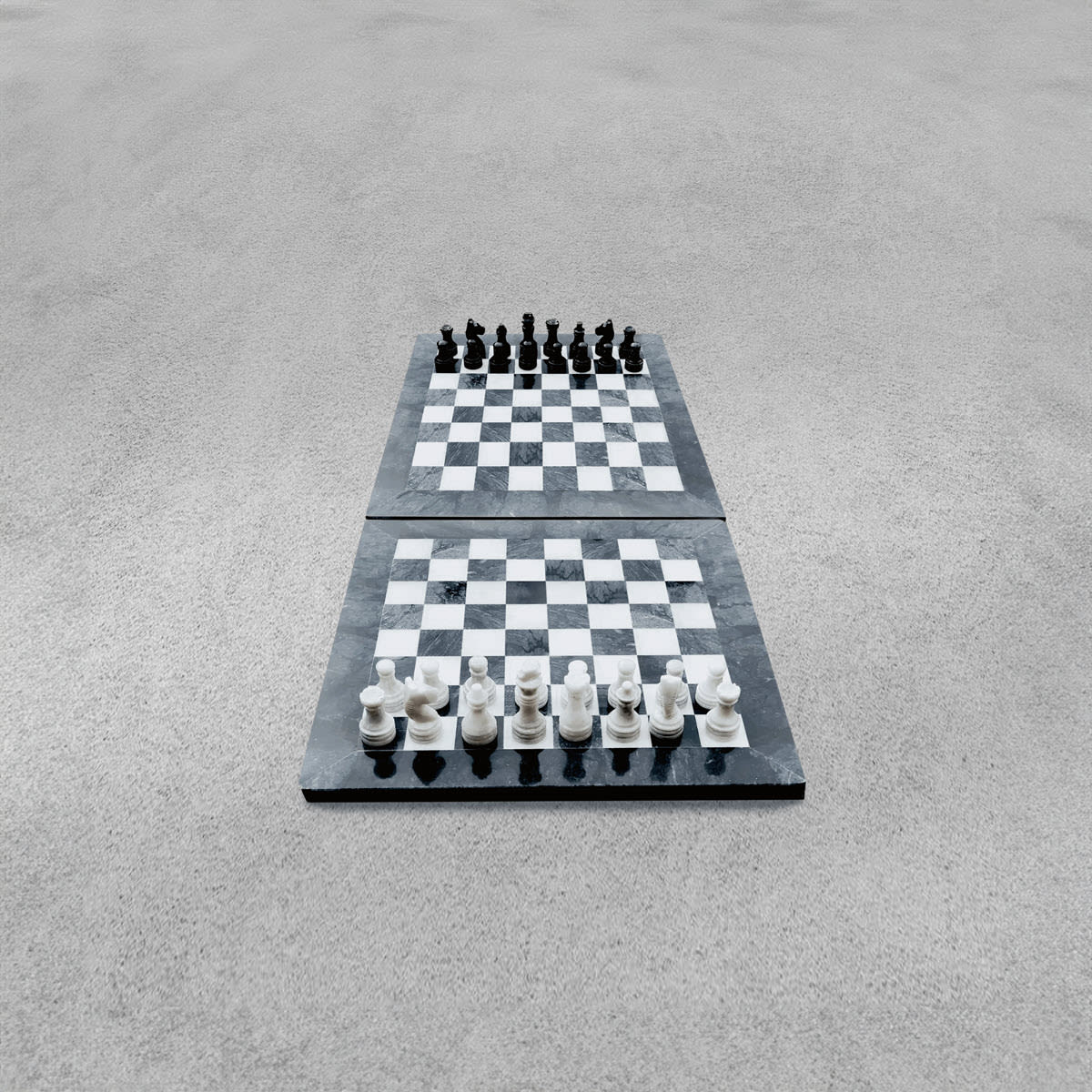

Although collective foundations pursue the same goal, they vary in terms of structure and the composition of their affiliated companies. Consequently, they can’t all invest according to the same model. Some foundations collect the funds of all companies in a joint investment pool. Others offer individual strategies, allowing each company to choose its own investment strategy in line with its specific risk capacity.

A growing company with a relatively young portfolio of members can hold a higher share of equities and invest over the long term. A foundation with many pensioners, on the other hand, must place greater emphasis on stable returns and lower volatility.

ALM analysis is a key decision-making factor

Comprehensive ALM analysis helps to determine a suitable investment strategy. Among other aspects, it provides insights into the following questions:

How do liabilities change when interest rates rise or fall?

What level of risk is acceptable for the employee benefits unit?

What amount of money does the foundation require to pay out pensions and benefits, and when?

These insights are incorporated into the strategic asset allocation, which determines how much of the money is invested in equities, fixed-income securities, real estate or other investments – and how long the money can be tied up.

Conclusion: secure and sustainable employee benefits provision

Investing in the field of employee benefits entails responsibility – towards the affiliated companies and their members. Diligent asset liability management means healthy returns and long-term security for benefits. Collective foundations thus need to constantly adjust their investment strategy to reflect actual needs and obligations.

Sound investment solutions

The GEMINI Collective Foundation offers its affiliated companies investment opportunities that are tailored to their respective structure and risk tolerance. There are various investment pools with different equity exposures (0%, 25%, 35%, 50%) to choose from, as well as individual strategies starting from an asset value of CHF 10 million. Each employee benefits unit is managed separately, complete with its own balance sheet, coverage ratio and full transparency.

News & Expertise

Expertise

ExpertiseGovernance and responsibility: who takes the investment decisions in a collective foundation?